Date:

China freight rates rising

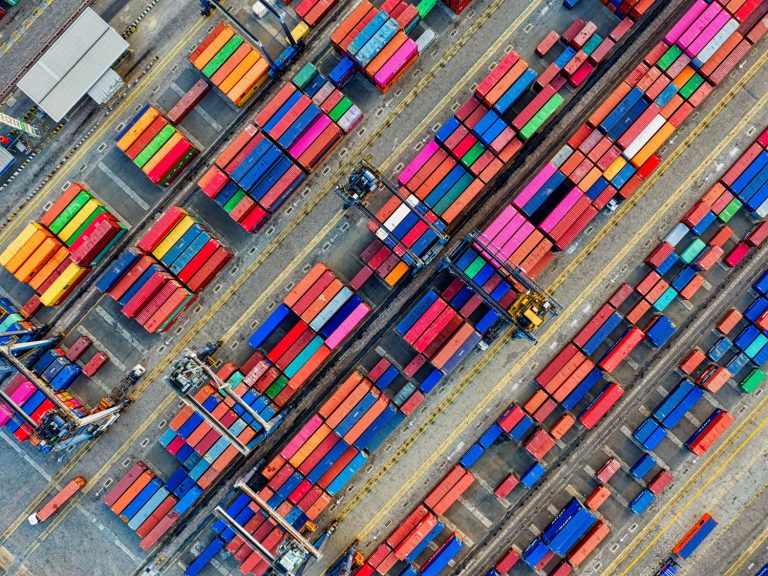

Asia press sources are reporting on surging freight rates, amid massive reductions in air and ocean capacity, following the weeks-long labour shortage and ongoing disruptions to logistics that have been hampering manufacturing operations in China.

Reduced airfreight capacity has resulted in rates doubling or tripling for flights leaving China to Europe and the US, with unsubstantiated reports of desperate shippers paying up to six times the regular rate.

The situation is also worsened by the cancellation of thousands of passenger flights to and from mainland China, resulting in the reduction in belly capacity for cargo.

The spike in air freight rates and the continuing shortage of belly-hold space will encourage larger volume shippers to turn to the air charter market, in preparation for the anticipated March rush, but charter rates have also increased, with rate doubling on some lanes.

Dockers and port logistics workers are returning to their posts following the easing of travel curbs, with Reuters reporting that some ports have surpassed processing rates to clear the backlog.

Shanghai’s port of Yangshan, the biggest deepwater container port in China, cleared 59,800 TEUs (twenty-foot equivalent units) on Feb 20, exceeding the average daily volume in 2019 of 54,200 TEUs.

But even as ports work to clear the massive backlog, the increase in blank and void sailings are contributing to delays in the supply chain.

Lloyd’s List reported that capacity cuts over the eight-week period since the CNY on Asia-Europe trade is expected to reach 700,000 TEUs, far higher than the post-CNY reduction of just 340,000 TEUs in 2019 and 210,000 TEUs in 2018.

For UK exporters there will be a pendulum effect, as the blank sailings affect backhaul, with limited capacity for outbound services from Europe, which means that market rates for ocean freight are likely in the short to medium term to go up, although this will be less volatile than airfreight.

Shippers will invariably move away from airfreight wherever possible and switch to alternative solutions, like Metro’s Sea Air service, which offers transits from 11 days at a fraction of the cost of air freight, via its dedicated Singapore hub.

Local reports suggest that about 75% of factories and offices on the mainland have opened, but the availability of production workers continues to be the biggest concern, with half or even less than of production employees back at work.

One key lesson that the outbreak has underlined for shippers is the critical importance of contingency plans and diversified supply chains.