Date:

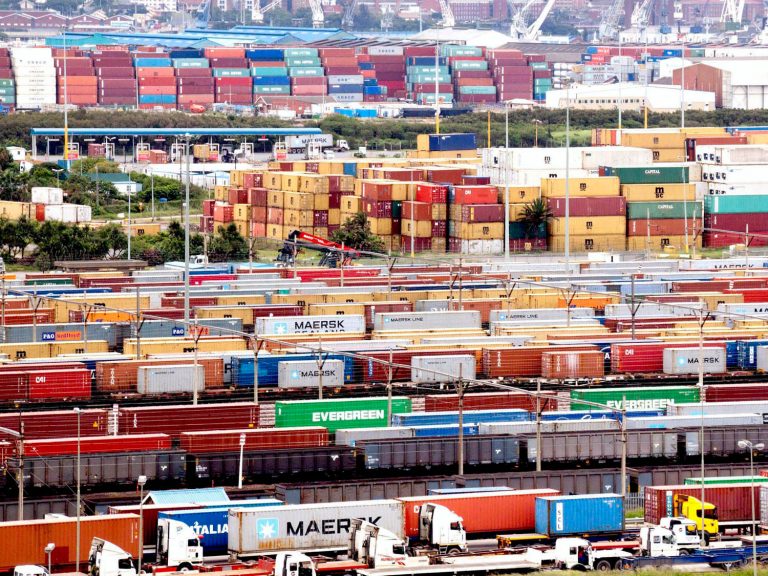

Northern Europe’s Ports Struggle with Congestion Amid Network Shifts

Ports across Northern Europe are grappling with rising congestion, causing widespread delays and operational disruption. A confluence of industrial action, infrastructure strain, inland transport bottlenecks and the rollout of new shipping alliances is overwhelming terminals, with no immediate relief in sight.

Container volumes have surged at key gateways such as Antwerp-Bruges, Bremerhaven, Rotterdam, and Felixstowe, with waiting times and yard occupancy levels climbing.

Antwerp is experiencing yard utilisation at 96%, with reefer plugs over capacity at 112%.

Nearly half the vessels arriving are waiting for berths, and 52 more containerships are en route. Berthing delays are being exacerbated by residual backlogs following strikes at the end of March, and the port has reduced its export delivery window to five days to help ease pressure.

In Germany, Bremerhaven is seeing similar strain, with nearly 30% of vessels waiting for berths and inland rail disruptions further complicating the situation. Landslides and line closures near Hannover forced lengthy rail detours, impacting traffic to and from major ports including Hamburg, Rotterdam and Duisburg. These rail delays are causing a cascading effect across Northern Europe’s inland logistics.

The Netherlands is also under pressure, with unresolved automation disputes in Rotterdam contributing to labour-related delays. In France, strikes at Le Havre have eased for now during ongoing negotiations, but the risk of renewed action remains high.

The UK is not immune. Felixstowe, London Gateway, and Southampton are all dealing with congestion as vessel diversions from continental ports push volumes higher.

Multiple factors are compounding the problem. The phasing in and out of new alliance schedules—particularly by Maersk, MSC, and Hapag-Lloyd—is disrupting established flows and increasing port calls. Simultaneously, low water levels on the Rhine are limiting barge capacity, shifting more freight to already stretched rail and road networks. Labour shortages, especially during public holidays, have further constrained operations.

With delays mounting, carriers are urging shippers to collect containers promptly and to avoid early delivery of exports. Some terminals, like PSA Antwerp, have shortened delivery windows to reduce yard congestion. Carriers are implementing contingency plans on a vessel-by-vessel basis and may introduce congestion surcharges to offset rising operational costs.

Industry forecasts suggest that congestion could persist for another three to four months, until alliance network changes bed in and volumes normalise. In the meantime, importers and exporters should prepare for longer lead times, increased costs, and fluctuating capacity at Europe’s busiest container ports.

With congestion disrupting major European gateways, our flexible contingency plans are keeping cargo moving, rerouting through alternative ports and opening up new entry points.

To reduce delays and protect your supply chain, share your shipping forecasts early so we can act fast and proactively manage risks.

For expert advice and tailored solutions, EMAIL Andrew Smith, Managing Director, today.